Is It Better to Pay Off Subsidized or Unsubsidized First

Many college students have. How to Find the Best Part-Time Job.

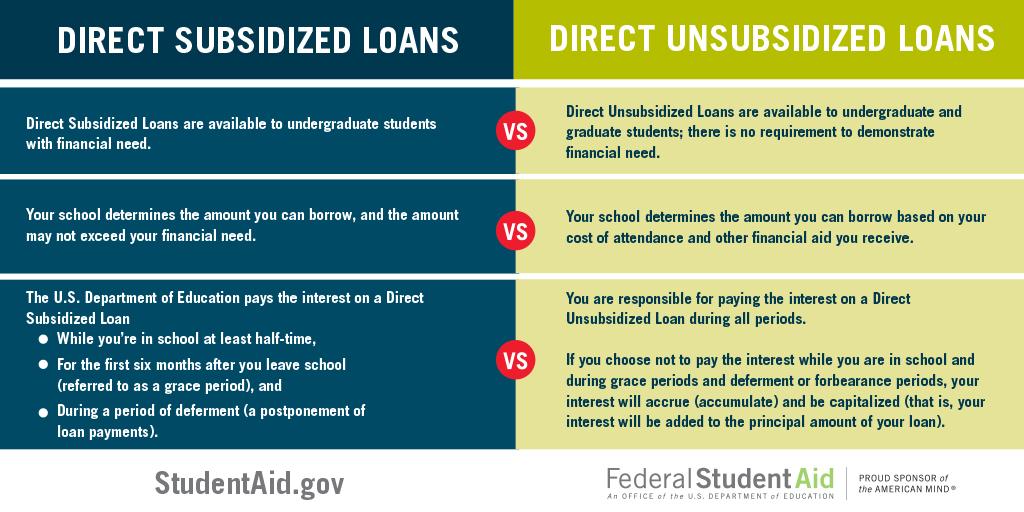

Federal Student Aid On Twitter What Is The Difference Between Subsidized And Unsubsidized Loans Find Out Http T Co Gz9nnvpavy Http T Co Nsig6dmckh Twitter

The debt avalanche method can help pay down and pay off multiple student loans faster which.

. Theres more than one way to pay off debt. Say I take out a 3500 loan to pay for school my freshman year at an interest rate of 429. Her work has been published by Experian Credit Karma Student.

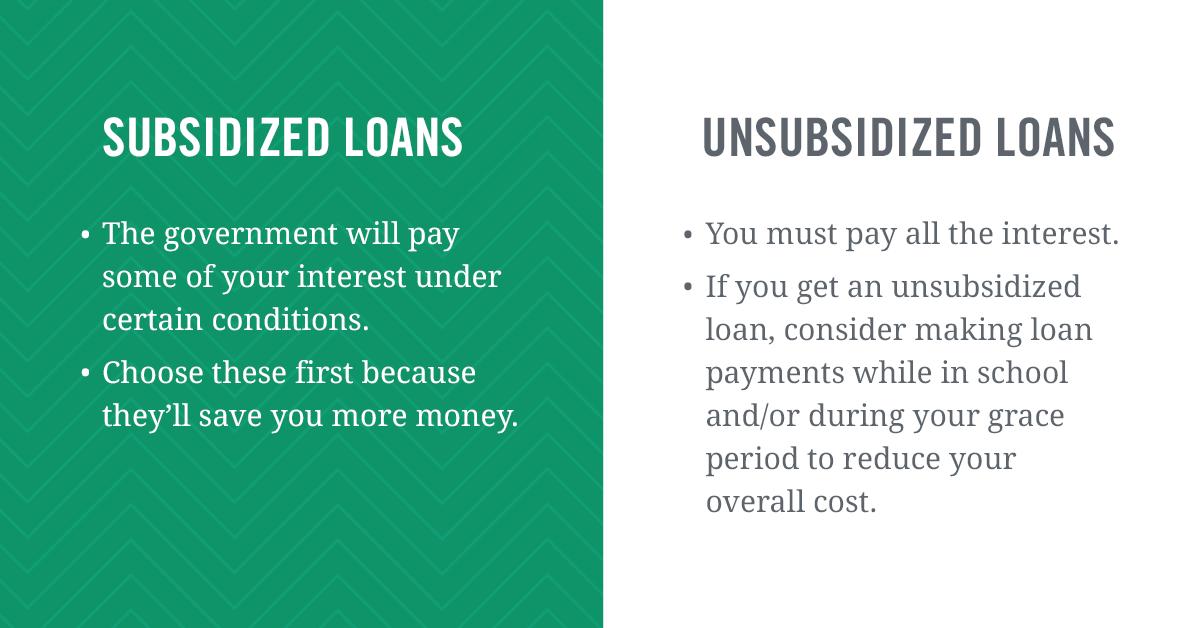

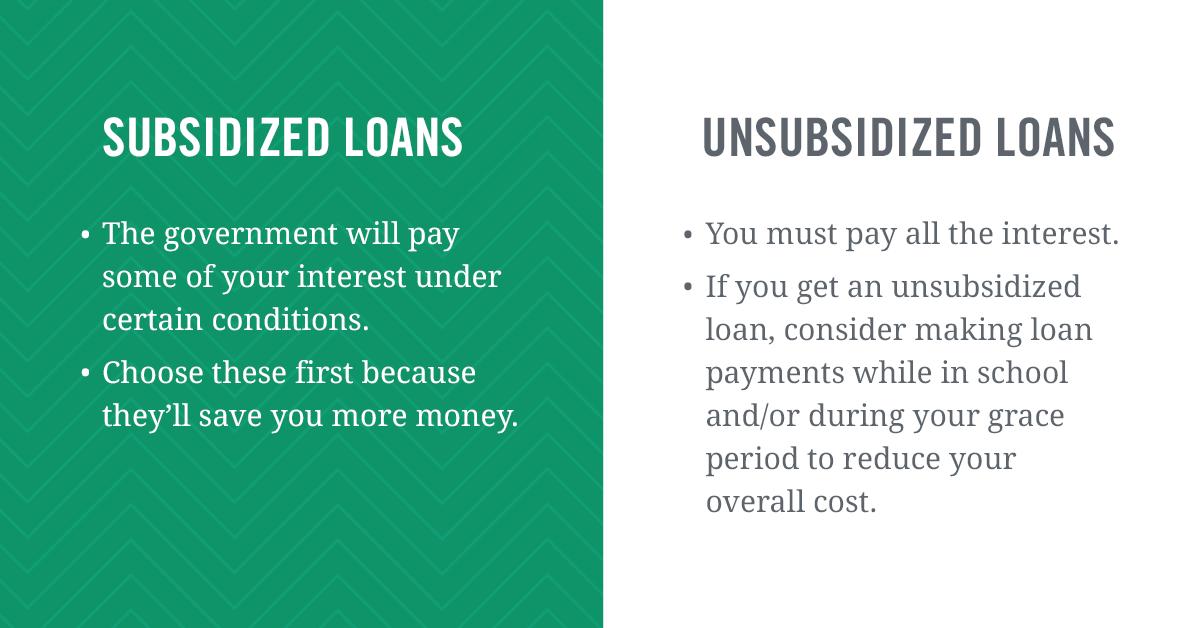

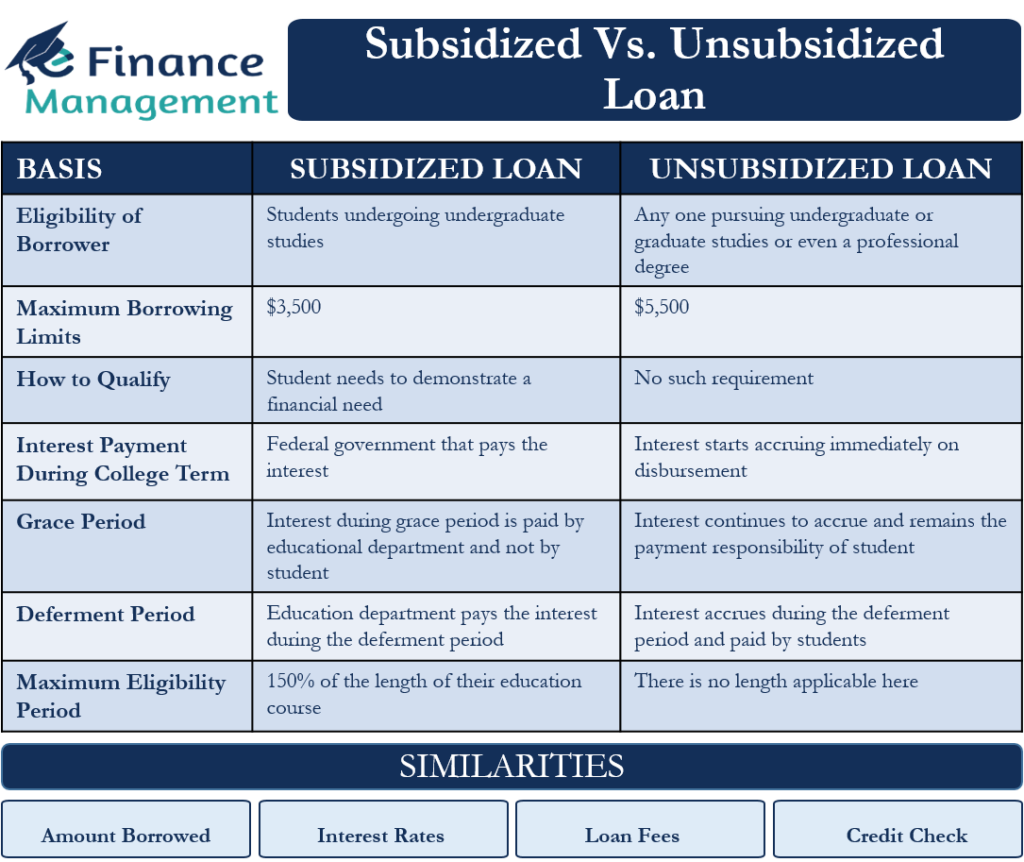

Quick tip Keep in mind the differences in each type of loan you have such as subsidized versus unsubsidized or private loans which likely have different annual percentage rates and interest accruals. How to find scholarships. All about Parent PLUS loans.

Try the debt avalanche or debt snowball strategies. The reason why you actually are going to college. More Student Finances.

How to pay for college. Applying for Financial Aid. Step one for securing financial aid is to fill out a Free Application for Federal Student Aid FAFSA at fafsaedgov.

All about Federal Stafford Loans. Loans help you pay for tuition and other expenses but must be repaid. How to use the College Scorecard.

Credit is complicatedlearn the basics here. Off campus Federal Work-Study jobs are limited to nonprofit non-sectarian and non-political organizations. What if financial aid is not enough.

All about 529 plans. Make extra or early payments without prepayment penalties. A general rule of thumb is to either pay off your highest interest debt or focus on the smallest outstanding balances the snowball method first.

How to use the Net Price Calculator. Theres a limit on the number of academic years that you can receive direct subsidized loans for those who fall in this category between July 1 2013 and July 1 2021. Direct Unsubsidized Loans offered by the US.

How to read a financial aid award letter. Skip a payment and make it up later. The chart below outlines different outcomes based on loan type if I dont make any payments.

1 in 10 Students Carry College Debt 20 Years Later. The Cost of College. The Difference Between Subsidized and Unsubsidized Student Loans.

First-Time Borrowers. Loans are backed by the Department of Education. Kat Tretina is is an expert on student loans who started her career paying off her 35000 student loans years ahead of schedule.

The Complete 2020 FAFSA Guide. Department of Education are a common example. Adjust your payment date anytime with ease.

Youll have to pay any interest that accrues while youre in school and during grace periods or deferments resulting in higher total loan costs and monthly payments than you would rack up with a subsidized loan as the earlier example. Ill use an example here to demonstrate long-term financial outcomes of a subsidized vs. Increase payment anytime to pay off loan faster.

You should know the following about TLF. The Increasing Cost of Attendance. You must have been employed as a full-time teacher at an eligible school for five complete and consecutive academic years and at least one of those years must have been after the.

Weve put together a library of essential resources like how-to guides comparisons and calculators to help you make better choices. Forgives up to 17500 of your Direct or FFEL Subsidized or Unsubsidized Loans after 5 complete and consecutive years of teaching at a qualifying school. How Much of a Difference Could It Make.

Federal Student Aid On Twitter Thanks To Everyone Who Replied The Correct Answer Is False You Are Responsible For Paying The Interest On A Direct Unsubsidized Loan During All Periods Learn More

Subsidized Vs Unsubsidized Loan Differences And Similarities Efm

Top 5 Questions About Subsidized And Unsubsidized Loans Financial Avenue

No comments for "Is It Better to Pay Off Subsidized or Unsubsidized First"

Post a Comment